Uncertain Times Breed Certain People

By Lindsay Humphrey

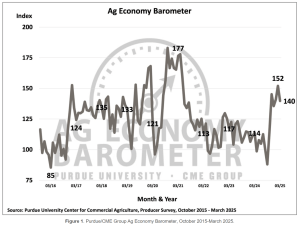

Year after year, we continue to live in unprecedented times that are becoming increasingly uncertain. Data backs up this sentiment as Purdue University continues conducting monthly surveys gauging producer optimism on the Purdue/CME Group Ag Economy Barometer (Figure 1).

“According to the March barometer, future expectations were pretty high,” Karst said. “It’s only been that high a few different times, but since then, it’s trended down because the tariffs were enacted. This tariff situation is a big deal.”

President Donald Trump made good on his promise to impose tariffs on our immediate neighbors to both the north and south while also sharing the love across the ocean. “When the tariffs were put in place, the stock market went down ten or twelve percent in the first two days,” Karst said. “There were massive losses on that front. A few days later, they withdrew the tariffs from everyone, but China and the stock market had one of the biggest rallies in history.” This is evidence of the uncertainty that exists in most marketplaces.

“Corn and beans both dropped dramatically when the tariffs were imposed,” Karst said. “Corn has mostly recovered, but beans are still slightly below what they were previously. Cattle are also slightly lower because we export a lot of beef, and both China and Mexico retaliated with their tariffs on US goods. The question now is: has this affected agriculture? Probably not in real dollars, yet.”

Let’s Look at a Chart

“This is more of an opinion-based survey, but it hits the heart of what people are feeling and thinking,” Karst said about Purdue’s ag economy barometer. “When you get down to the basis of any decision we make, they’re primarily based on feelings.”

October 2024 was the last major low point on the barometer before it shot up in November. Many speculate that November’s optimism was due to the election, but it’s likely a function of many factors. For Karst’s take on that, read here.

“Back in November, farmers felt there would be less regulation and the opportunity to be a lot more profitable under this new administration,” Karst said. “It’s gone up and down ever since. As an index, the numbers themselves don’t mean much other than 100 is around neutral. I’d argue that 120 is a little more accurate of a neutral feeling. Regardless, I like using these charts to get a feel for how farmers look at the future as different things happen.”

Because of the uncertainty, bankers and farmers have been hesitant to make long-term decisions. This year’s “loan renewal season“ has proven tough on both. While this doesn’t apply to everyone, some farmers could not pay off their 2024 operating loan before getting a new one for 2025.

“I know a lot of farmers stored more grain than usual which is one reason for the financial struggle, but plain and simple, some didn’t make enough money to pay the bills,“ Karst said. “As we talked to bankers, many struggled to renew operating loans. Usually, they’re done by now, but it’s hard to issue a new loan on a red-line business.“

The numbers don’t lie at the end of the day. Look at the 2025 Crop Cost and Return Guide (Courtesy of Purdue University) to see for yourself.

Some Positivity to Take Home

Uncertain times breed people who can take a glimmer of hope and ride that wave to the bank, even if it takes a few years to cash in on that glimmer physically.

“We’ve been in uncertain times like this before and stood firm,“ Karst said. “The rescinded tariffs are good news, of course. While cash rent did not go up this year, farmers who own land will be better off than those who rent the land they farm. Some crop input expenses are down slightly, and land values are steady.“

Just like in every uncertain, unprecedented time before this, land is the most valuable and consistent asset in a financial portfolio. Farmland is a real, tangible asset that is an excellent inflation hedge. As farmland sales hold steady at Halderman and even show some possibility of marginal increases, Karst wants to remind his audience to stand firm in the face of uncertainty as the world depends on the US for food, fuel, and fiber.